An interactive discussion on Real Estate titled ‘Real Estate: Trends, Issues & Consequences’ was organized by Money life Foundation on May 5. The session was jointly conducted by industry experts like Pranay Vakil, Chairman of Knight Frank (India) Pvt Ltd and Pankaj Kapoor, MD, Liases Foras.

Photo by Phil SextonMr. Pranay Vakil said on the occasion, “One of the major reasons why the prices are high today is infrastructure. Nobody wants to travel long distances for work. Title insurance is another major issue in this industry.”

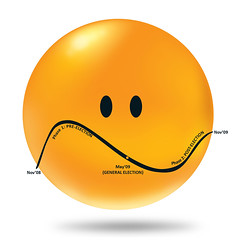

He added on being quizzed about the short recession, “Liquidity is vital. Developers realized this when sales volumes declined drastically due to the liquidity crunch. The slowdown gave customers ample choice as affordable housing came into the industry in a big way. Investors are ‘fair-weather friends’, Sell ‘ready’ products during a slowdown; contracts can be broken; healthy growth can be sustained by a gradual increase in prices; high-value transactions hyped by the media are not the ‘real’ market and the need is to innovate sales strategy.”

Mr. Kapoor said, “Are we heading towards another asset bubble? Are the prices affordable? What is wrong with the valuation and where is affordable housing? The government is responsible for hiking prices. We need a regulator for this industry to grow and curb wrong practices.”

The workshop witnessed enthusiastic participation from several investors, research analysts and industry experts in form of healthy exchange of ideas between them.

Ms Kavita Hurry, CEO, ING Vysya Mutual Fund asked the speakers to highlight three major issues in the sector.

On which Mr. Vakil said “Three most important things we need in real-estate as a priority are—rental housing, all over the world there is organized rental housing. Here you are left at the mercy of the broker who does not know anything. Secondly, infrastructure— the government cannot be a provider, it can be a facilitator. Thirdly, all these need funds, so get foreign parties excited about India.”

Mr. Kapoor said, “We need to address the congestion issue in the island city. If we move five buildings from the island city to Bandra, there will be a whole shift in the crowd. If we can shift Mantralaya, BSE or the Income-Tax office, there will be a difference. There are three-four magnets which draw the crowd there. Everyone knows about it but there is no intension to do that because they are sitting in luxurious places. We need to add more connectivity. We need a complete master plan for Mumbai to reduce the congestion. We need a regulator, and urban planning.”

Other industry experts also voiced their opinion.

The audience reached to a consensus which was that there is an immediate need for a citizen action forum to make higher authorities listen.

quences