The number of high net worth investors (HNIs) and corporates seriously looking to invest in Indian office space has increased manifold in the last few years. Mumbai continues as India’s numerous office space investment destination, with companies from all over the world unerringly zeroing in on the financial capital.

As South Asia’s only true financial hub, Mumbai is among India’s best places to invest in commercial real estate. In times of global economic uncertainty, investors flock to markets that have consistently proved their long-term stability and fundamentals.

In a scenario wherein institutional investors are showing reduced preference for commercial real estate in their portfolios, Mumbai continues to present HNI and corporate investors with myriad growth opportunities in office properties. However, the multitude of options also gives many enthusiastic investors heartburn -where on Mumbai’s vast and complex map are the low-risk/high returns locations?

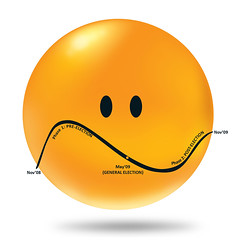

Today, Mumbai as a city for commercial space investment reveals a high rate of vacancies in many locations. The rental yields in these micro-locations are expected to decrease marginally over the next 12 months.

While this seems to present a depressing scenario on the surface, the fact is that we are now looking at the bottom of the curve. In other words, these markets are expected to bottom out over the next one year and will consequently start to move up again. These locations have significant long-term capital value appreciation potential, and well-informed investors are keeping a close eye on them.