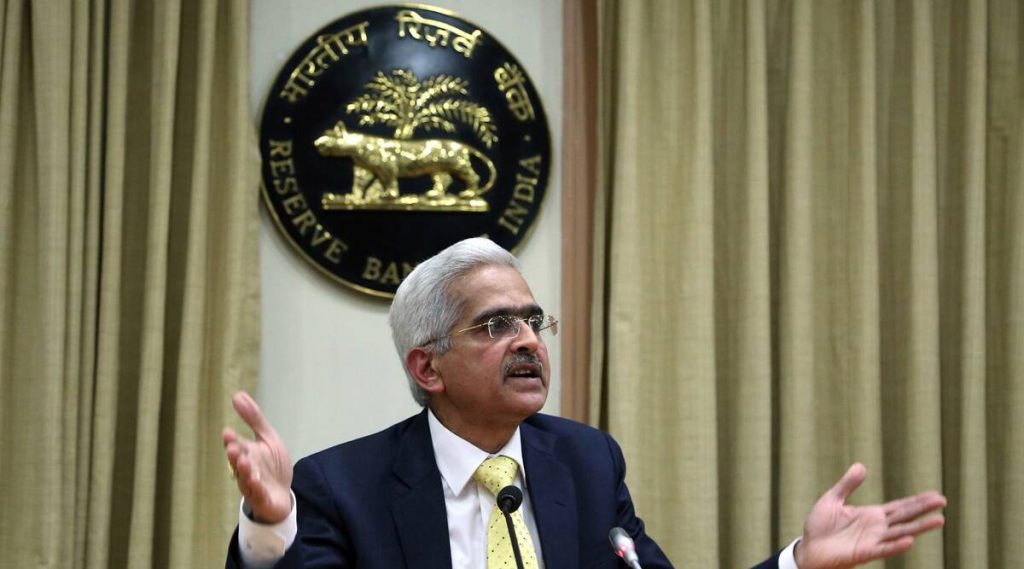

Builders have urged the Reserve Bank of India (RBI) to consider a loan restructuring, a moratorium on interest payments, and extra liquidity support to the real estate sector. This comes after RBI Governor Shaktikanta Das announced on Wednesday a covid relief package for individuals, small businesses, and MSMEs.

The RBI Governor has mentioned a number of measures and arrangements in his statements. Such as the second round of loan restructuring and other relief measures as well as the term liquidity facility of about Rs 50,000 crore for healthcare and SLTRO for Small Finance Banks. The central bank also recognized the difficulties faced by individuals, small businesses, and small and medium-sized enterprises. Due to downsizing, and provided resolution 2.0 measures to restructure loans to small borrowers of up to Rs 25 crore.

CREDAI encouraged and hoped that similar measures would be announced in the coming days. To address the problems of large companies and labor-intensive sectors such as real estate.

It is hope that RBI consider real estate sector as well!

This was stated by the President of CREDAI Harsh Vardhan Patodia. We are convinced that the measures that make accounts classified as SMA 1 and SMA 2 also suitable for restructuring. An interest rate moratorium together with additional liquidity under ECLGS 3.0 transferred to real estate projects will help in reviving the economy and create jobs that are most important to compensate the influence of the second wave.

This was stated by the President of NAREDCO, Niranjan Hiranandani. The RBI governor announced a number of plans. Including the second round of loan restructuring and other relief measures, steps in the right direction. It is hoped that he will also look at industries as real estate that need similar support in these difficult times. We expect consistent, calibrated, and timely action across industries such as real estate.

Samantak Das, chief economist and head of Research & REIS, JLL India said. Apart from individual borrowers, this will be of great help to SMEs associated with the real estate sector, especially resource providers for this sector.

Also read:-

UP-RERA working with state government to end flats registration deadlock

ICICI, SBI, LIC, HDFC, other life insurers set to invest in InvITs, REITs