It is never easy to find answers for the questions like how to buy a house, which option is best for me, or whom to rent my house, etc. Although these questions are important to one, but people forget the most basic question which is ‘when to buy?’.

Someone has rightly said “Never bite off more than how much you can chew”. One must always be realistic and look forward to a house according to his own budget.

The financial planners advice you to have a thumb rule that never go for a property for which the EMI loan amount exceeds 40% of your take home. You must be careful enough and make sure that the return on investment pitch given to you by the broker or the builder doesn’t fool you.

Next, the reverse mortgage schemes offered by the financial institutions can be of great use in the latter years of life if so required. At any point of time, one must not give a thought to how much money he can save in the long run if a house is purchased.

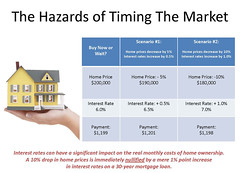

Another area which one must consider is that the decreasing interest rates and the increasing real estate rates are not always a nice combination. Thus, one must be careful enough while selecting his dream home.

Finally, especially for the individuals who are on the drive of establishing themselves, the financial advisers suggest not to have heavy loan burdens as it may hinder their growth.