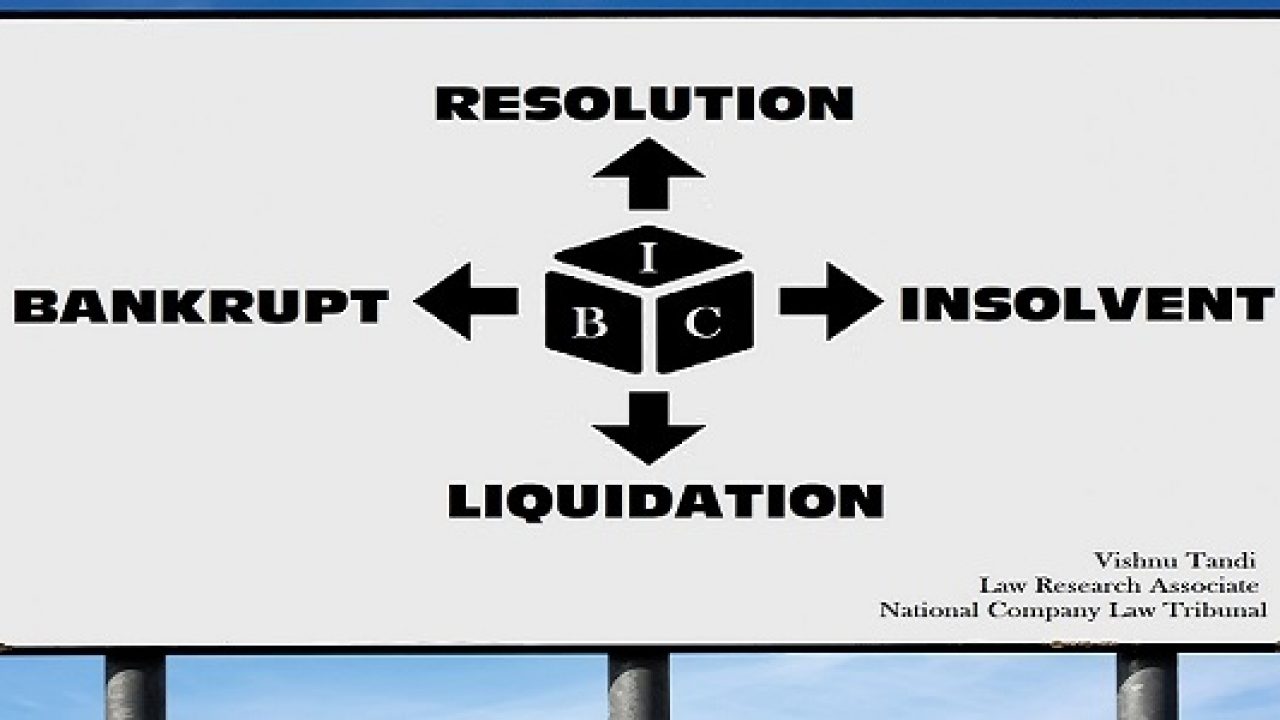

MUMBAI: In a move focused at smooth resolution of wiped out firms, the finance ministry is considering waving off the 21-day national lockdown from the bankruptcy resolution process remembering the hardships faced due to the nationwide lockdown. Individuals aware of everything additionally said that the waiver period could be extended in accordance with the national lockdown. Under, India’s indebtedness and bankruptcy code bankrupt firms get 270 days to finish the goals procedure.

Despite the courses of events contained in these guidelines, however subject to the arrangements in the Code, the period of lockdown forced by the Central Government in the wake of COVID- 19 outbreak. This will not be counted for the purposes of the time-line for any action that could not be finished due to such lockdown, according to a corporate insolvency goals process.

The finance minister has currently quoted that if the disruption brought by coronavirus broadens then it would suspend the utilization of the corporate bankruptcy resolution process for quite a while. The finance minister had additionally expanded the base amount of the default required to start the insolvency goals and liquidation forms against organizations from one lakh rupees to one crore rupees.

“In regard of continuous IBC processes, delays are natural as the investing locality is expected to be more anticipating about their offers and in many scenarios whether to bid at all – attributing to the lockdown, the best of businesses are concentrating on cash protection and this will demonstrate an immense challenge for the insolvent organizations and their RP’s. Elongation in the bid process is a significant scenario, and anticipate it should be supplemented by improvement of the RP period as stated by Sanjeev Krishan, partner and leader – Deals, PwC India.