The crash of coronavirus in Wuhan, China and it’s detection in Delhi-NCR region has altered the business posture harshly. The Indian real estate industry would likewise be influenced indirectly as allied organizations such as steel, heavy machinery and other crude materials are intensely reliant on Chinese import.

Coronavirus has contaminated more than half a million people globally and has claimed over 96,000 (as on 10th April 2020) lives across the world. With the World Health Organization (WHO) announcing it a worldwide health emergency, the economic status is seriously affected. The outbreak has built a big plethora of uncertainty with respect to trade and imports, in China as well as around the world. The real estate industry is not even at mercy. This will have an immediate bearing on the costs of steel and different articles utilized in the development business in India.

Coronavirus influencing commercial and retail real estate in India

While India has so far been less influenced by the Novel Coronavirus when contrasted with East Asia, the infection is spreading like fire across the country. Undoubtedly, the real estate sector is concerned; specialists actively opine that it would impact the industry unintended, as the nation is vigorously subject to imports from China.

The ongoing rise in COVID-19 cases has affected retail consumption as individuals have begun to maintain social distance from crowded areas, particularly entertainment complexes, and shopping centers, among others. While well being and health of employees have taken the focus of interest for the most of the corporates, the companies are progressively concentrating on workplace hygiene, remote working arrangements and expanded reception of adaptable workspace options alternatives.

What are the effects of Coronavirus flare-up on REITs?

Current analysis propose that the side effect from the COVID-19 virus outbreak is anticipated to be an obstacle for arranged venture and fundraising exercises through Real Estate Investment Trusts (REITs) this year. Any arranged or proposed fundraising activities through REITs would be set aside for later for the span that the pandemic supports.

Designbuild Pvt. Ltd., Koshy Varghese, MD, quoted that the impacts of the shutdown are starting to be felt by the real estate investment market. Thinking about the targets being met is the main trouble by all concerned stakeholders.

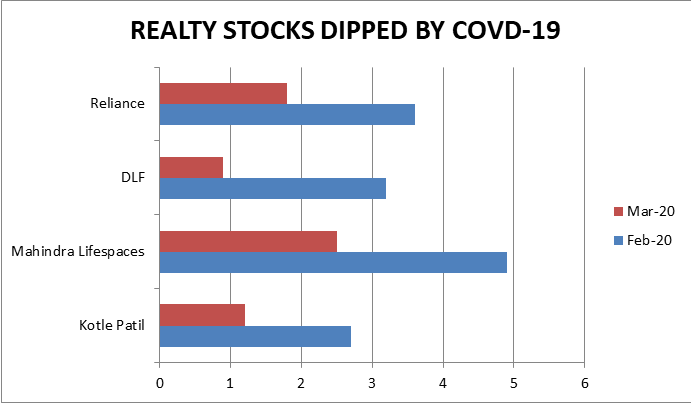

Magnificent losses suffered by real estate stocks after coronavirus outbreak. (Source :https://www.moneycontrol.com/ )

Measures many builders and employees taking to guarantee the safety of homebuyers and its workers

In the midst of such misery, conventional real estate practices have become a tightrope to stroll as realtors are attempting to balance responsibilities with measures to ensure workers, purchasers and themselves. These incorporate ailment of strict hygiene rules inside the premises, social distancing and even abolishing events. To begin with, countless builders have already rolled-out precautionary measures to feature their apartments which includes temperature screening, acquiring travel history announcements and flaring up cleaning frequency inside the workplaces.

Worldwide, each company is enduring work from home culture. Probably the biggest companies the country over, a swathe of start-ups, and technology majors have requested their representatives to work from home.

Other than self-taken measures, the guidelines issued by the National Association of Realtors additionally propose alternate marketing events for realtors, including video tours, e- brochures and others to virtually tour a property. Moreover, the visitors are provided with masks to guard themselves as well as other people.

Conclusively, with current reports of Coronavirus arriving in Delhi-NCR and Noida, the real estate industry needs to brace itself for an even worse effect than recently suspected. With the danger of contamination impacting human lives, the real estate sector can expect a dunk in property visits and a lower purchaser interests. Every calamity is a chance to attain new stature. Indian real estate and united manufacturing companies must find positivity in the situation and benefit by expanding production and indigenous advancement.